| Archive: | ||

| 8079787776757473727170696867666564636261 | 8887868584838281 | |

| 6059585756555453525150494847464544434241 | 4039383736353433323130292827262524232221 | 2019181716151413121110987654321 |

| Index | ||

Our $48 trillion debt

Seattle PIDavid Horsey

May 19, 2008

You are invited inside Horsey's inner sanctum to discover what's on the mind of the editorial cartoonist. Big thoughts about the world that didn't make it into a cartoon? Burning questions for readers to debate? The inside scoop on how a cartooning commentator gets the job done? It's all of the above, plus the occasional unpublished sketch and off-the-wall observation.

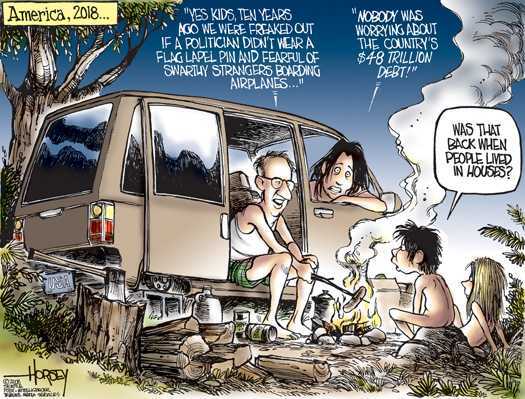

Our $48 trillion debt

What inspired me to draw the cartoon with the family camped out in their van in a post-financial-collapse nation, America, 2018?

In part, it was an intriguing commentary by Kevin Phillips in the Washington Post.

Phillips asks if the USA is nearing the sort of economic freefall that knocked past dominant societies off the top of the international heap. The $48 trillion debt referenced in the cartoon is the total debt, public and private, for all Americans, not just the government debt. That debt is just one of many factors that could be driving us toward decline. Phillips puts today's situation in historical perspective:

Here, then, is the unnerving possibility: that another, imminent global crisis could make the half-century between the 1970s and the 2020s the equivalent for the United States of what the half-century before 1950 was for Britain. This may well be the Big One: the multi-decade endgame of U.S. ascendancy. The chronology makes historical sense -- four decades of premature jitters segueing into unhappy reality.

The most chilling parallel with the failures of the old powers is the United States' unhealthy reliance on the financial sector as the engine of its growth. In the 18th century, the Dutch thought they could replace their declining industry and physical commerce with grand money-lending schemes to foreign nations and princes. But a series of crashes and bankruptcies in the 1760s and 1770s crippled Holland's economy. In the early 1900s, one apprehensive minister argued that Britain could not thrive as a "hoarder of invested securities" because "banking is not the creator of our prosperity but the creation of it." By the late 1940s, the debt loads of two world wars proved the point, and British global economic leadership became history.

How bad might things get? Well, we may not end up living out of our cars, but we could learn the hard way what happens when a country can't stop itself from buying far more than it produces.