EPI

L. Josh Bivens

August 2, 2006

Monetary policy makers face a tough tradeoff: they want to have the economy operating robustly enough to generate employment and wage growth for most Americans, but not to the point of overheating and sparking excessive inflation.

The economy, however, sent a mixed message in the second quarter of 2006: job growth decelerated rapidly compared to the first quarter, yet most measures of inflation still ticked up. This had led to a debate about what the Federal Reserve should do about interest rates in coming months, with many advocating that the higher inflation numbers argue for slowing the economy by clamping down even further on the labor market via increased interest rates.

Ben Bernanke, Chairman of the Federal Reserve, has rightly suggested that rising inflation isn't always the result of pressures coming from the labor market, saying in his recent testimony before the Senate Banking Committee:

Profit margins are currently relatively wide, and the effect of a possible acceleration in [labor] compensation and price inflation would thus also depend on the extent to which competitive pressures force firms to reduce [profit] margins rather than pass on higher costs.

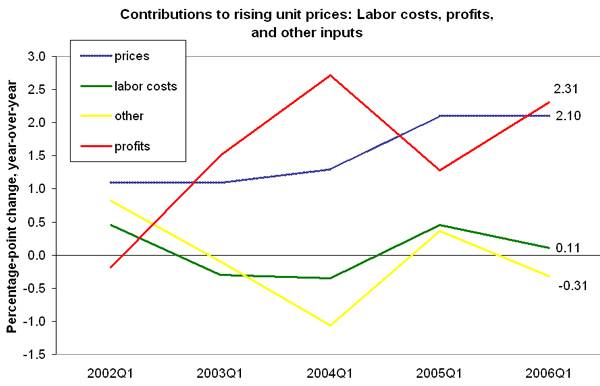

The chart below illustrates just how much of the recent rise in one measure of inflation 1 has been driven by labor costs, profit margins, and other inputs, respectively.2 From the first quarter of 2005 to the first quarter of 2006, unit prices in the non-financial corporate sector (i.e., about 65% of the private sector) have risen by 2.1%. Since labor compensation barely kept pace with productivity over this time, unit labor costs added only 0.1% to prices. Rising profit margins, conversely, contributed 2.3% to price growth. Other inputs subtracted a small bit from price growth. In essence, the entirety of price inflation in the non-financial corporate sector over the last year can be explained by rising profit margins.

The cause of rising prices in recent years is not labor costs, and any effort to contain inflation shouldn't pin the bull's eye on American workers' paychecks.

Notes

1. This non-traditional measure of inflation is the price per

unit of value-added of non-financial domestic corporate business.

The non-financial corporate sector accounts for about 65% of the

private sector in the United States. To be clear, this is not the

consumer price index (CPI), the most commonly used measure of

inflation. The CPI directly includes the price of some goods,

like oil, that have shown much higher rates of inflation in the

recent past, and, it measures only the price increases of

consumption goods. The inflation measure here looks at the price

of all final goods (not just consumption goods) produced

domestically in the U.S. by the non-financial corporate

sector.

2. The data are from the Bureau of Economic Analysis' series on price, cost, and profit per unit of real gross value-added of non-financial domestic corporate business. The unit price measures from this series is an untraditional measure of inflation (it has run lower than other measures in recent years), but it does allow a direct accounting for the various influences on rising unit prices. Due to rounding errors, the original series doesn't always allow the components of price increases to sum to 1. The graph in this snapshot uses the calculated weights of labor costs, profits, and other inputs in contributing to price growth to account for 100% of the observed price change in each period.

Commentary: